During my time supporting quarterly marketing and sales planning, I was responsible for overseeing and validating targets and budget allocation, program strategies, and then ensuring their successful implementation along the quarter. A process known as building and executing the Playbook in the tech industry.

To effectively support this mission, I had to develop a 360° approach to problem-solving, combining business analysis, data analysis, and business intelligence. This hybrid expertise allowed me to bridge strategic objectives with operational execution, ensuring that decisions were data-driven and aligned with business goals. A company’s strategic objectives dictate the type of strategic analysis required, whether the focus is on growth, launch, or revitalization. Each scenario demands an adaptable approach, requiring synchronization across field teams: Marketing, Sales, and Operations. By aligning campaigns, programs, and sales plays with quarterly strategic objectives, a Data Analyst can plan, coordinate, and monitor cross-functional initiatives that drive measurable impact. The goal is to create symbiotic action plans that enable operational teams to execute efficiently, ultimately contributing to successful marketing and sales strategies.

In this section, we focus on Market Penetration that is a critical component of the Growth strategy. Successfuly increasing market share within the existing market ensures that high-performing products reach the right audiences in the most effective way. However, the challenge lies in identifying where to grow and determining how to maximize adoption. This Playbook outlines the key pillars of scaling market presence, structured around my core learnings: Strategic Development [1], Marketing Program Planning [2], Marketing and Sales Optimization Strategies [3], and Key Performance Indicators [4].

1. Strategic Development

Market Penetration is a growth tactic, distinct from market expansion, focused on increasing market share within an existing market by capturing more customers, increasing product adoption, and outcompeting rivals. To ensure scalable and sustainable growth, a structured approach is required. This approach must align strategic planning, analytics, and execution for maximum impact.

Mission. The first step in driving market penetration is to identify and prioritize high-potential opportunities within an existing market. This involves the following steps:

| Identify high-potential markets | Identify a target audience already supplied or serviced based on market demand forecasts, product fit and competitive landscape. |

| Differentiate market positioning | Establish a clear competitive edge in the Red Ocean market to reinforce brand identity dominance and position the product as the strongest alternative to existing solutions. |

| Align targets | Align product, marketing, and sales efforts to the newly set targets based on demand forecasts, competitor’s benchmarking and positioning. |

| Priotitize strategies | Evaluate and propose models involving high intent channel priorisation, predictive targeting, competitive takeover plays or strategic conversion partnerships … |

Analytics. To ensure market penetration strategies are informed and actionable, analytics play a critical role in shaping decisions. Key analytical areas include:

| Competitive intelligence | Assess and benchmark competitors’ positioning, growth strategies, and weaknesses to exploit opportunities. |

| Market share analysis | Estimate the market demand and understand where the product stands relative to competitors to identify growth levers like untapped customer segments within the existing market. |

| Pricing analysis | Optimize pricing to capture competitor customers and improve product adoption. |

| Brand equity and product sentiment audit | Clarify how the brand can enhance its market perception and how the product should differentiate from competitors by leveraging pricing, features, speed and service through positioning like value-based, premium, innovative problem-solution, customer-centric, legacy, sustainable or just competitor-based. |

| Sales Forecasting | Set up market penetration targets based on forecasted market demand and predicted market share shift based on budget, expected return, and conversion efficiency. |

| Growth Opportunity Mapping | Surface actionable opportunities and optimizations from competitors strategies, industry trends, customer needs, pricing dynamics, behavioral data, and internal performance metrics. |

Execution. Effective execution requires a structured approach to lead focus, performance optimization, and key metrics tracking.

| Lead Prioritization Framework | [1] Quality: The framework starts with quality, focusing on high-intent, high-value leads to maximize conversion efficiency. [2] Velocity: Next comes velocity, optimizing the sales cycle by nurturing engaged prospects effectively. [3] Volume: Only after quality and velocity are optimized does volume scale, ensuring sustained growth without compromising efficiency. |

| Key optimizations | [1] Refining Targeting: The process begins with refining targeting, ensuring that resources focus on high-intent, high-value accounts for maximum conversion potential. [2] Refining Messaging: Then, refining messaging strengthens differentiation by aligning engagement strategies with competitive positioning to accelerate deal velocity. [3] Scaling Conversion: Finally, scaling conversion ensures that once targeting and messaging are optimized, sales execution and operational efficiency drive sustained growth at scale. |

| Key metrics | [1] Market Penetration Rate: The most important thing to track is the capture of a larger market share to know if our positioning strategy is effective. [2] Customer Lifetime Value: Then, we focus on lead quality profiling, customer experience, execution and retention to extend relationships and profitability. [3] Win Rate: Finally, we optimize targeting, lead qualification, and sales execution to increase conversion rates and maximize deal success. |

2. Marketing Program Planning

The marketing team needs to attract and acquire new high-intent, high-value leads to fill the sales funnel, this is called pipeline generation. Once qualified leads are identified, marketing collaborates with sales to isolate and nurture these prospects efficiently, accelerating their progression toward conversion—this is pipeline acceleration. Balancing resources between pipeline generation and pipeline acceleration is crucial for sustained revenue growth. To ensure efficient budget deployment, my marketing teams divided their investments between Traditional Funnel strategies and Account-Based Marketing (ABM) approaches. Traditional marketing focuses on casting a wide net to generate leads and acceleration their progression through the pipeline using broad-reaching channels and tactics, while ABM takes a highly targeted approach, engaging specific very high-value accounts with personalized strategies.

The following table breaks down the marketing budget allocation to follow best practices in product growth, assuming B2B SaaS companies typically allocate approximately 8-10% of their annual revenue to marketing.

| Marketing Budget Allocation | Traditional Funnel | Account-Based Marketing | Total Allocation |

|---|---|---|---|

| Pipeline Generation | 35% | 50% | 85% |

| Pipeline Acceleration | 5% | 5% | 10% |

| Customer Retention | – | 5% | 5% |

| Total Allocation | 40% | 60% | 100% |

Now that we have demonstrated how resources should be distributed to optimize quality lead acquisition and conversion, let’s see what programs should be favored for each approach.

Traditional Funnel Pipeline Generation Programs.

- Digital Demand Generation: Build landing pages and leverage paid ads, SEO, social media marketing and emails to capture demand. This is scalable and the performance is highly measurable.

- Outbound programs: Execute targeted cold outreach to high-value competitor customers to drive fast market share capture. Unlike ABM, which emphasizes long-term strategic account growth, this program can prioritize fast-cycles if executed well.

- Content Syndication: Distribute gated content hrough trusted third-party publisher networks to reach targeted audiences and generate leads at a controlled cost.

- Hybrid Event programs: Merge physical and digital experiences to drive cross-channel lead generation.

- Third-Party Events and Partnerships: Involve sponsorships, partnerships, and networking to expand reach.

- Thought Leadership: Work with experts to do some research and whitepapers to gain authority and credibility. This program is critical in the long run.

Traditional Funnel Pipeline Acceleration Programs.

- High-Touch Nurturing programs: Use personalized content, case studies, and direct engagement follow-up emails to move prospects through the funnel faster.

- Industry-driven Executive Engagement: Engage high-profile personas within key industries to accelerate deal velocity.

- Strategic Partnerships: Leverage reseller, technology integration, or co-sell partnerships to drive faster deal conversions and expand market access.

Account-Based Marketing Programs.

- Core ABM: Granular and account-specific ABM approach for must-win high-profile accounts involving tailored campaigns and hyper-personalized outreach and content like dedicated microsites, custom case studies, or co-branded assets to nurture and convert target accounts.

- Industry-driven ABM: Industry-specific and scalable targeting and messaging to engage multiple key decision-makers at once.

- Strategic Press Relations: Elevate brand credibility by building authority and trust through industry media coverage, speaking engagements, executive panels, key customer success stories and executive-centric Thought Leadership content, positionning the brand as a leader and the best alternative in the market.

Customer Retention Programs.

- Customer Support programs: Guarantee early success milestones and reduce time-to-value (TTV) to prevent early-stage churn through streamlined onboarding, smooth solution implementation, and fast issue resolution.

- Customer Expansion programs: Drive higher customer value through expansion via cross-sell and upsell.

- Loyalty programs: Special incentives for converts to prevent churn and deepen engagement. Further strengthen high-value relationships via Executive and Community Engagement.

- Win-Back programs: Re-engage previously churned or inactive customers by leveraging pricing offers, usage history, past pain points, and missed value milestones to rebuild trust.

3. Marketing and Sales Optimization Strategies

To maximize market penetration and lead conversion, marketing and sales programs must be continuously optimized throughout the quarter. The following funnel and ABM optimization strategies are structured around the Lead Prioritization Framework, ensuring a focused approach to capturing high-quality leads and accelerating conversions. The three pillars of cross-team optimization are prioritizing and engaging high-intent, high-value accounts, reinforcing competitive positioning and differentiation, and executing sales enablement and operational strategies to ensure efficient and fast conversion.

Lead Acquisition & Demand Capture Optimization Strategies.

| Digital high-intent inbound channels priority | Focus demand capture and engagement-based retargeting on high-converting sources, typically organic search (SEO), intent-driven paid ads and high-performing referral programs from partners and resellers : their CAC should be lower than outbound. |

| Ideal Customer Profile (ICP) targeting | Conduct sales performances analysis and deep customer research to map the most profitable customer segments based on Customer Lifetime Value (CLV). The mapping will enhance audience targeting to primarily ensure Digital Demand Generation programs strategically reach high-quality leads (cash cows). |

| High-intent audience predictions & targeting | Leverage behavioral signals and engagement scores to identify accounts most likely to convert. Predictive analytics will mostly help paid advertising programs and outbound efficiently reach high-intent audiences. |

| Competitive paint point driven messaging | Align messaging with competitor weaknesses like cost inefficiencies, product failures, unmet customer needs, or poor service reviews to craft a targeted pain point driven message that resonates with high-intent prospects and reinforces your solution as the superior alternative. |

| Competitive takeover plays | Execute aggressive win-back campaigns and outbound sales using competitive intelligence insights from the sales teams to convert dissatisfied competitor customers. Leverage competitor-specific case studies on how your solution helped a competitor’s ex-customer succeed or use migration incentives such as exclusive pricing offers for transitioning, premium onboarding, and data migration support. |

Lead Conversion & Sales Enablement Optimization Strategies.

| Personalization at Scale | Use behavioral analytics and insights from account-level data to segment prospects and create personalized outreach based on objections from past interactions and industry challenges (messaging, use cases, features and offers). Perform A/B testing to improve the personalization and adapt accordingly nurture flows and sales plays to maximize marketing ROI on large high-value segments (cows). |

| Competitive proof-based sales plays | Equip sales teams with documentation to better persuade switchers including side-by-side competitor comparisons, direct feature advantage breakdowns, and competitive case studies. |

| Executive-led competitive engagement | Involve your sales leaders in key competitive takeover plays, typically in 15-30% of deals, by leveraging high-touch executive outreach, peer-level discussions, and C-level relationship building to increase win rates in high-value deals. |

| Multi-threaded engagement | Engage multiple decision-makers within an account to expand influence, mitigate objections and prioritize high-intent buyers, accelerating the conversion. |

| Tiered outreach strategy | Map and target accounts based on value (ICP segmentation) and engagement level (predictive analytics) to enable a fastest deal closure approach. |

| Sales incentives | Drive motivation and performance by offering monetary incentives such as performance-based SPIFFs (sales performance incentive fund formula) for key objectives. Complement them with non-monetary recognition including executive visibility, career development opportunities, and exclusive training to further engage and reward top performers. |

| Operational excellence | Shorten the sales cycle by ensuring tactics are designed for repeatability and scalability. Automate repetitive tasks such as follow-ups, scheduling, and proposal generation using CRM-integrated tools like Salesforce or Microsoft Dynamics. Also leverage AI-driven tools to support conversation with prospects. Finally, oversee the system integration, data governance, territory allocation, reporting and analytics for more efficiency, capacity and predictability. |

High-Value Targeting & ABM Market Capture Optimization Strategies.

| ABM allocation | Dedicate between 10 to 20% of your total accounts to ABM, selecting them based on revenue potential, expansion opportunities, engagement levels, and strategic fit between the current ICP and the long-term business goals. Include high-value competitor customers to drive strategic market penetration and competitive takeovers. This selection process can occur at any stage of the sales cycle as new insights and opportunities emerge. |

| Executive Thought Leadership | Prioritize high-impact industry platforms such as top-tier media, keynote events, and advisory boards to position the company’s executives as industry leaders who can challenge your competitor narratives and vouch for your superior service, pricing, and speed of implementation. |

| Competitive takeover press | Secure media coverage on strategic customers who switched from competitors, reinforcing why your brand is the better alternative through compelling success stories. |

| Competitive PR defense and crisis response | Proactively counter negative competitor claims, product failures, or industry shifts through media engagement and executive messaging to maintain brand trust and strengthen market positioning. |

Account Value Expansion Optimization Strategies.

| Customer success acceleration | Deploy customer success managers (CSMs) to ensure fast onboarding, high feature adoption, and ongoing value specifically for ex-ABM accounts. Then they can turn critical wins into expansion and advocacy. |

| Time-based expansion play | Maximize customer lifetime value by capitalizing on the high-engagement window immediately after contract signature, typically 10% to 30% of the time-to-revenue milestone. Use this momentum to introduce relevant cross-sell or upsell opportunities while stakeholders are most attentive and strategic alignment is fresh. |

| Customer health profiling | Prevent churn by proactively identifying and engaging at-risk customers before disengagement becomes irreversible. Monitor key indicators such as solution utilisation trends, satisfaction scores and community engagement signals. Combine these insights to trigger automated and personalized expansion or win-back plays like value-add offers, free acess to premium features, seasonal packages or usage-based recommendations. |

| Advisory & advocacy intelligence | Leverage testimonials, referrals, case studies, co-marketing opportunities, and advisory boards to turn satisfied customers into active promoters. Use product usage insights and success milestones to identify and activate these advocates. |

4. Key Performance Indicators

Last but not least, let’s measure the impact of our efforts. To ensure we’re optimizing targeting, messaging, and conversion scaling, we need to focus on five key metrics that define performance and growth: Market Penetration Rate, Customer Lifetime Value (CLV), Win Rate, Lead-to-Opportunity Conversion Rate, and Pipeline Velocity. By consistently monitoring these KPIs, we can refine strategy, execution, and scalability to maximize market impact and revenue growth. Other metrics can be tracked to ensure control over lead quality, lead velocity and volume such as the Customer Acquisition Cost (CAC), Cost Per Lead (CPL), Return on Marketing Investment (ROMI), Marketing-Sourced Revenue Contribution, Pipeline Growth Rate, and Retention Rate.

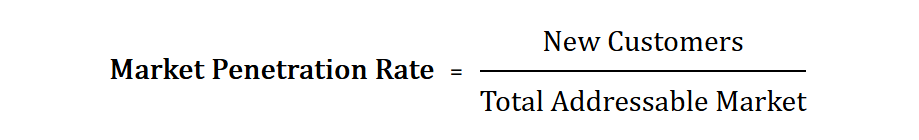

Market Penetration Rate. It evaluates product adoption within the target industry. A higher rate indicates strong customer acquisition and competitive displacement, while a low rate signals the need for better demand generation, sales execution, or pricing strategies. In the B2B SaaS sector, achieving 5-15% penetration is already considered a strong performance.

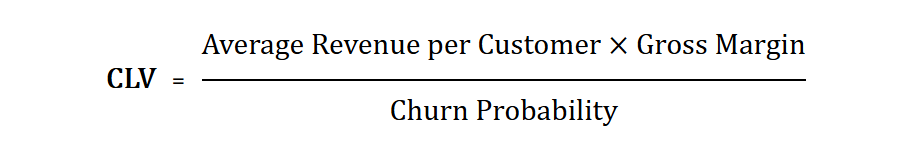

Customer Lifetime Value (CLV). It evaluates long-term revenue potential of acquired customers, as market penetration isn’t just about winning customers but keeping and growing them. Quality leads have a high CLV, ensuring that acquired customers remain profitable and reducing the long-term cost of penetration; conversely, low CLV signals a need for better lead quality selection, improved customer experience, stronger retention strategies, or more effective upselling initiatives. Also note that if the ratio of CLV to Customer Acquisition Cost (CAC) is less than 3, penetration efforts may be unprofitable. The following is a simplified approach, and you can find a more detailed breakdown in my customer retention post.

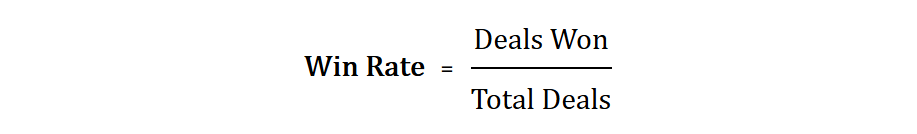

Win Rate. It measures how effectively a company wins competitive deals, reflecting pipeline efficiency, strong lead targeting and qualification, and sales execution strength. A higher win rate means the company successfully converts competitive opportunities, while a low win rate signals issues in sales enablement, pricing, or differentiation. Win rates vary by business model, deal complexity, and competition level, but in tech, best practice is to maintain a win rate above 15%.

Lead-to-Opportunity Conversion Rate. It measures how effectively marketing-qualified leads (MQLs) progress through the funnel and turn into sales opportunities. A higher conversion rate indicates high-quality MQLs, meaning leads are well-targeted, engaged, and ready for sales. If the rate is low, it signals issues in lead nurturing, targeting, or qualification processes, requiring better segmentation, scoring, or follow-up strategies. Achieving a conversion rate above 10% in Funnel Marketing is already a healthy performance, while in Account-Based Marketing (ABM), pre-selection of high-value clients raises the conversion standards to at least 30%.

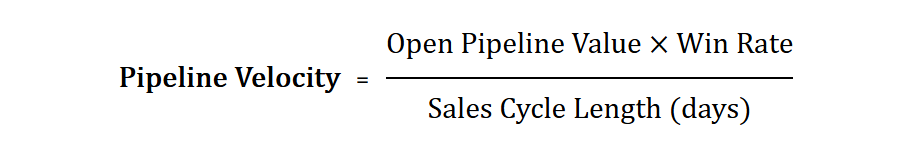

Pipeline Velocity. It tracks how quickly leads convert into revenue, reflecting sales efficiency and deal momentum. A higher Pipeline Velocity means deals are moving faster through the pipeline, leading to quicker revenue generation and improved sales performance. To calculate it, you need to determine Sales Cycle Length, which is the average time it takes to close a deal, from the first interaction to final contract signing. In B2B SaaS companies, Pipeline Velocity typically aligns with sales cycles of 3 to 9 months.